Like something out of a badly written B grade movie, Section 66A sounds boring, and it also sounds like something a lawyer would uncover at the final hour before a school gets demolished in favour of a minimart. It’s neither of those things. But it is more than it seems.

Late last year, I happened to be in a meeting with others who receive the Supported Living Payment. And one of them happened to ask if the rest of us knew about “Section 66A.” We all shook our heads. Me being me, I immediately went to find out.

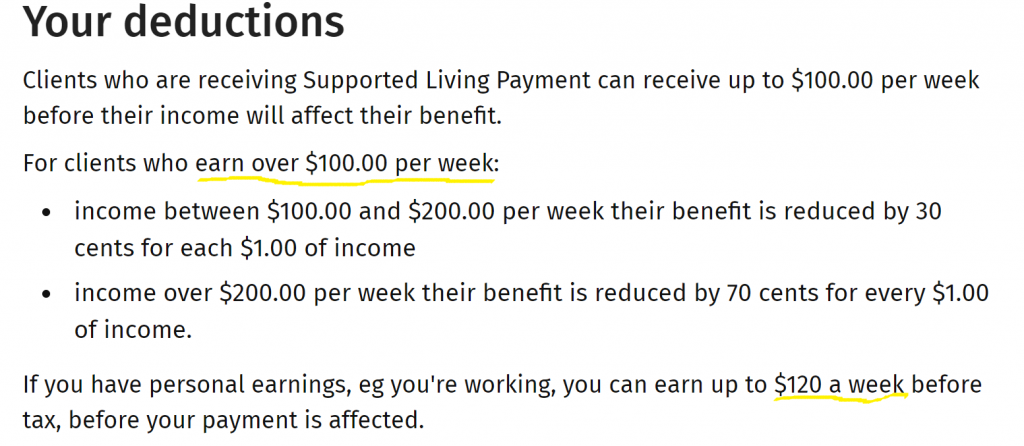

Sorry to jump in with numbers, but here’s some quick background facts, directly from Work and Income’s website:

>> People on the Supported Living Payment can earn $100 /week before tax before their benefit is reduced For ever dollar over $100, your benefit is reduced by 30 cents. If you earn over $200, it’s reduced by 70c for each dollar.

>> People on a Jobseeker benefit can earn up to $80 /week before tax; for every dollar over $80, your payment reduces by 70 cents.

When I finally had my application for the SLP approved, this acknowledged that I met the conditions, being:

- you must be either permanently and severely restricted in your capacity to work because of a health condition, injury or disability.

Ie, you:

- have a condition affecting your capacity to work for more than two years, OR

- have a life expectancy of less than two years AND

- can’t regularly work 15 hours or more a week in open employment

- or, you are totally blind.

In approving my application, WINZ agreed that I am “severely restricted in my capacity to work because of my health condition or disability.”

When I moved to the SLP, the new rate was instated. I was slightly better off financially, but mostly happy it meant I don’t have to prove I’ve still not cured of my incurable illness every three months.

However, they forgot to take into account that my earning deduction rate had changed. So, whenever I earned over $80, I was losing 70c of each dollar.

I should have realised this myself, but the letter I get every week about how much I’ll receive just says “We’ve reviewed your payments because your income is xx. You get $xx.” They don’t give you a detailed breakdown.

So. We jump ahead, and I’m researching the mysterious 66A.

Section 66A of the Social Security Act states the following:

66A: Special Exemption for Severe Disablement.

For the purposes of computing any benefit payable, the chief executive may in the chief executive’s discretion, as an incentive to personal effort, disregard all or part of the income of any severely disabled person derived from such effort.

Huh. The earning exemption that’s automatically given to blind people – which I fully support – can be given to others with disabilities too. But only if they know about it, if they have the resources to apply, and if the Chief Executive of the Ministry of Social Development decides that the exemption will incentivise us to work.

There’s just so many things wrong with this.

I dithered about whether to write the letter. I felt very uncomfortable about asking to be treated as “special” – to be granted an exemption, when there’s nothing different about me, I’m just privileged to have the education and support system I do. I had two lawyers help me with the letter. I wasn’t going to suddenly be working 20 hours a week if they “incentivise me,” because I can’t, but I thought it would be great to keep more of what I can earn.

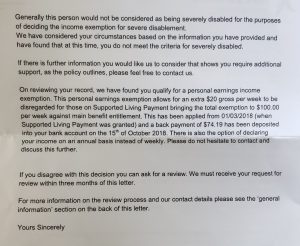

It didn’t matter. My “application” – I don’t think I can call it that; there’s no official form, there’s a letter to an executive – was declined. The reason? I’m not disabled enough.

What I found so hilarious about this letter was their claim that, all of a sudden, they had found I was entitled to a “personal earnings exemption” of $20. I’m not entitled to any sort of personal exemption in this regard – this was what was supposed to have been happening ever since I moved to the SLP. It’s only because I asked questions that they rectified it – but they’ve bizarrely lined it up as some sort of consolation prize.

I sent the letter to my lawyer friend. I said that I didn’t know if it was worth arguing – after all, they’re right. Despite my arthritis severely limiting my life and employment abilities, I don’t consider myself severely disabled, not in comparison to many others.

But he advised me they hadn’t followed the law – they’d followed a “policy” that we couldn’t see. So we went back for another round.

We laid out two arguments, the first addressing the legal failure, and the second refuting their qualification of me as not severely disabled.

We sent the letter as an appeal, which enacted a process where they would internally review their own decision.

I got a letter saying they, surprise surprise “consider [the] decision to be correct.”

If I wanted to take this further, I was told the next step was a hearing, which I was invited to attend.

I read the letter many times. The legal advisor and I discussed the idea of a complaint to the Ombudsman, but with the hearing as an option, it was unlikely the Ombudsman would intervene at this stage. I thought about the stress involved in a hearing, and whether there was any chance I’d actually win.

In the end, I rang Work and Income and said I wanted to withdraw my appeal – what was the process for this? “Oh, no worries,” said the friendly man on the other end of the phone. “We make it very easy to withdraw.”

Yes. I bet you do.

What’s next?

I still didn’t feel ok about letting it end there. I think it’s bizarre, appalling, and unethical to withhold information about this piece of legislation from people who might qualify, and to never offer assistance to enact the process.

So, just before Christmas, I put together a comprehensive list of questions to send to the Ministry of Social Development for answers under the Official Information Act.

Due to public holidays dragging out the timeframes, I only got a response this week – and it’s no response at all. Several of my questions, they say, they have decided not to answer because of the time it would take to collate the information. The rest, they have advised me they will respond to by 5th March.

More than three months since I submitted the OIA request.

I have been on the other side of OIA processes, and I know they take time and valuable resources. But I needed to be clear about exactly why they’re refusing to provide information that they must certainly have, even if not in immediately accessible form. So I wrote back asking that question.

I’m guessing they’ll consider that a separate request, and therefore an additional 20 working days to answer.

In the meantime, I received another strange letter. This one was an apology. It told me that in fact, I can earn $120, not $100. That’s supported by this information on their website:

So… if I earn over $100, the benefit is reduced by 30c, … but also actually I can earn $120 before it’s reduced?

Pretty much, apparently. According to my letter, the $100 is an “income abatement,” and the $20 is a “personal earnings exemption.”

Is anyone else confused?

Either way, I’m keeping all the records.

In conclusion (for now):

Your level of disablement doesn’t necessarily indicate your level of ability to work. I know people who meet the criteria for 66A who can work fulltime. I cannot, because of my disability, and yet I am not allowed to have my income exempted so that I could use what I do earn to better support myself. Isn’t that Work and Income’s intention? To get people working as much as possible? It’s right there in the wording of 66A – it’s meant to “incentivise” us disabled people to work more. For me, my work is it’s own incentive; I’m lucky enough to want to do it. But I’d be dishonest if I didn’t admit that being financially set back from working more, doesn’t exactly encourage me.

One day, I’m going to be well enough to not have to deal with any of this. And I still consider myself lucky to have the education and support I need to deal with it at all. For too many people, that’s not the case.

I’ll provide an update when I get the OIA answers, which might be sometime this century.

To be continued…

Thanks for pressing on with this.

Thanks for sharing this info and pushing for an appropriate result.

Good luck

even though I have university level intelligence,I actually cannot deal with this level of circumlocution-I simply glaze over;turn off…it’s not a conscious decision;I just can’t get my head around these words.So I grieve for the clients who left school at 15 and have no way of understanding these words…it’s not fair.These are not law students,don’t expect them to be able to navigate your process.

I’d just like to say a word about the review process in case it’s helpful for anyone else reading. I used to be a review officer for ACC, which clearly is not the same thing, but similar (I was employed by ACC but was statutorially independent from them, which was enormously important in the decision making process, and WINZ’s review people also are not employed by WINZ.) You mention the stress of the process which you took into account in deciding not to continue with your application, and sure, it can be a stressful prospect, both in terms of the hearing itself and also in terms of the expenditure of effort, energy and potentially money if you hire a lawyer (which isn’t obligatory) and whether it’s worth it is absolutely for you alone to judge. However, from my perspective, what was expressed to me over and over at the end of reviews was what a relief the review process had been to them as they were at last able to talk about their situation with someone who would listen to everything they had to say and make a decision which was not biased by everything that had gone before. I have no idea what the success rate is of WINZ appeals, but I overturned a hell of a lot of ACC decisions. So I would encourage anyone considering a review to look at both sides of it – the stressful side, but also what might be a positive side for them that they hadn’t thought might be there – before making their decision.

A Benefit Review Committee is always comprised of two MSD staff members and one community member who is compensated by MSD. The two MSD staff members do not act independently, and hold the majority at Committee hearings. It is rare for a decision of the Committee to be in favour of the beneficiary, as the Committee’s MSD staff members are briefed and cases are deliberated beforehand. Reasonings for decisions are brief and of poor quality. The Social Security Appeal Authority has a higher rate of decisions in favour of beneficiaries than Committee hearings, and cases ordinarily must first go through a Committee hearing to be brought before the Authority. It is not uncommon for the Authority to find in some cases that the positions of both the beneficiary and MSD are incorrect. Both forms of hearings can be degrading for beneficiaries, facts and personal circumstances that have little or no relevance to the matters in question are often heavily scrutinised.

My concern is that you did not continue with the Review of Decision.

Section 66A was in the 1964 Act, it has been replaced in the 2018 Act with regulations which say the same thing. I don’t have it in front of me but I just looked it up for a client.

They were most certainly wrong if you were losing 70 cents in the dollar over $80 that applies to Jobseeker Support.

$100 a week is exempt as you have found, then there is the $20 personal earnings exemption. The latter is qualified with “earned through your own efforts” so it does not apply if the income is from investments or something where you do not have to do anything.

The problem with the severely disabled exemption is that it is only asked for if you are earning more than $120 per week, or $220 when the abatement really kicks in at 70 cents in the dollar plus tax.

What we have found is that when people went to the Social Security Appeal Authority with that level of income, the question was raised about whether you were entitled to the benefit in the first place because it appeared that you were working more than 15 hours a week.

At one stage Work and Income had a policy that said that section 66A applied to all Invalids beneficiaries, now called Supported Living Payment. But because people started asking for it they took that away.

There is a subtle difference in that Supported Living Payment is for being permanently and severely restricted in your capacity to work, which is not the same as Severely disabled.

Hmm 66A as it was before the new SS Act was in addition to the $20 if the income is from personal effort and the Wk&I systems require manual adjustments within their abatement calculator for the $20 to be added to the 100 or 200. This is because the default in the abatement system is income in not from personal effort (savings, rent as landlord…).

This is no excuse for not doing the manual processing whenever income is declared.

Graham